Working out the Fringe Benefits Tax (FBT) can easily be a sophisticated and time-consuming activity for services. Nevertheless, along with the assistance of a novated lease, this method may be simplified dramatically. In this step-by-step overview, we will describe how a novated lease works and how it can produce FBT computation easier for employers.

Action 1: Understand What a Novated Lease Is

A novated lease is an agreement between an employer, worker, and a financial company. It makes it possible for an employee to lease a motor vehicle of their selection while their company takes on the task of making the lease settlements on their account. The employee then settles the company through regular salary rebates.

Step 2: Determine if Your Service is Entitled for FBT Exceptions

Before taking into consideration a novated lease as a technique to streamline your FBT calculation, it's significant to calculate if your business qualifies for any sort of exceptions or giving ins relating to FBT. These exceptions may vary relying on factors such as the style of organization you function and the utilization of the lorry.

Measure 3: Pick the Right Novated Lease Provider

To ensure that your FBT computation is simplified along with a novated lease, it is crucial to pick the appropriate company who recognizes your organization requirements and gives extensive assistance throughout the method. Look for providers that use on-line calculators and resources to support in determining FBT obligation effectively.

Measure 4: Determine Your Staff member's Annualised Distance Travelled (ADT)

One significant element in determining FBT responsibility is an staff member's annualised proximity travelled (ADT). This recommends to the total number of kilometers driven by an staff member in both work-related and personal use over an whole entire year. Precise record-keeping is vital for this measure.

Step 5: Find out Business Use Amount

To work out FBT, you require to figure out the service use percent of the auto. This includes always keeping monitor of all auto usage and sorting it as either organization or exclusive usage. The greater the organization make use of percentage, the lower the FBT obligation.

Step 6: Determine FBT Obligation

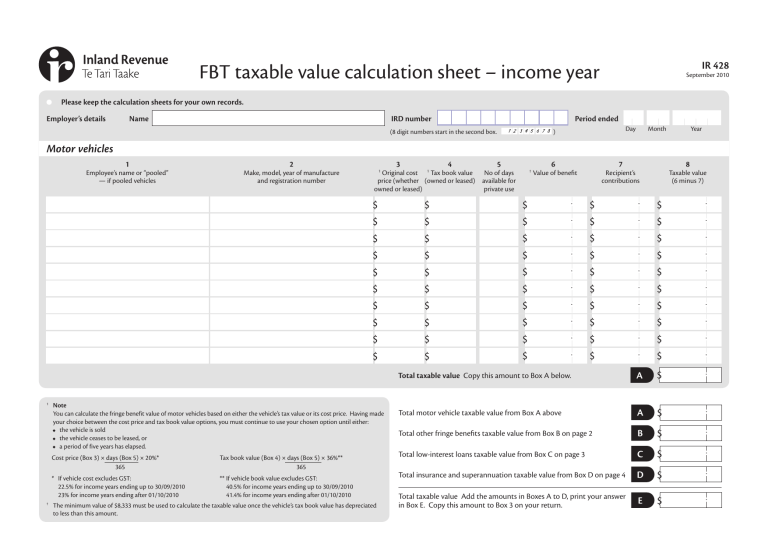

With a novated lease, working out FBT responsibility ends up being simpler as most providers use internet personal digital assistants that instantly produce precise amounts based on the details given. These personal digital assistants think about aspects such as the price of the auto, lease condition, passion rates, and various other variables.

Measure 7: Keep Accurate Records

To make certain conformity along with tax guidelines and simplify potential FBT estimates, it is important to maintain accurate records of all pertinent info. This consists of files of lease repayments created through the company, worker salary rebates, and any type of modifications in motor vehicle consumption throughout the year.

Step 8: Look for Professional Advice

While a novated lease can easily streamline your FBT estimation dramatically, it's constantly wise to find qualified recommendations from an accounting professional or tax obligation specialist. They may provide beneficial ideas particular to your company and aid guarantee that you are maximizing any type of offered exceptions or concessions.

In novated lease FBT calculator , streamlining your FBT calculation along with a novated lease may save your business opportunity and initiative in dealing with fringe ben